Thomas Insurance Advisors for Dummies

Wiki Article

Thomas Insurance Advisors Can Be Fun For Anyone

Table of ContentsThomas Insurance Advisors - TruthsSome Ideas on Thomas Insurance Advisors You Should KnowSome Known Details About Thomas Insurance Advisors Indicators on Thomas Insurance Advisors You Need To KnowA Biased View of Thomas Insurance AdvisorsThomas Insurance Advisors Can Be Fun For Anyone

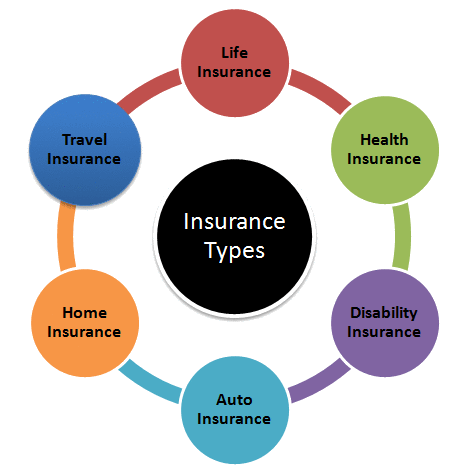

Auto insurance is a plan that covers you in case of crashes or other incidents involving your automobile. It can cover damage to your cars and truck and also responsibility for any kind of injuries or home damage you might trigger. Several sorts of car insurance policy include responsibility, collision, and extensive protection. An annuity is a financial product that supplies a guaranteed income stream for a set period of life.Accident insurance policy is a plan that gives monetary settlement in instance of injury or death. It can cover clinical expenses, lost earnings, and also various other accident-related expenditures. Disability insurance policy is a policy that provides financial backing in situation you end up being unable to function because of a health problem or injury. It can cover a part of your income and aid you to cover your living costs.

Understanding that your last costs are covered can supply peace of mind for you as well as your loved ones.

The 25-Second Trick For Thomas Insurance Advisors

It can cover routine check-ups along with unanticipated diseases or injuries. Travel insurance coverage is a plan that gives financial defense while you are taking a trip - Insurance in Toccoa, GA. It can cover trip terminations, lost luggage, clinical emergencies, and also other travel-related expenditures. Travel clinical insurance is a policy that especially covers medical expenses while traveling abroad.

Therefore, it can shield circumstances where the obligation limitations of other policies are surpassed. Oral insurance is a plan that covers the cost of dental treatment, consisting of routine checkups, cleanings, and also much more considerable dental procedures. It can additionally cover orthodontic treatment, such as braces. These are just a few of one of the most common kinds of insurance policy policies.

More About Thomas Insurance Advisors

If you have any kind of inquiries regarding insurance coverage, contact us and also ask for a quote. They can assist you select the best policy for your demands. Get in touch with us today if you want tailored solution from a certified insurance representative.Below are a few factors why term life insurance is the most popular type. The cost of term life insurance premiums is determined based on your age, health, and the coverage quantity you call for.

HMO plans have lower month-to-month costs as well as lower out-of-pocket prices. With PPO strategies, you pay higher month-to-month premiums for the freedom to utilize both in-network as well as out-of-network providers without a reference. Nonetheless, PPO strategies can result in higher out-of-pocket clinical costs. Paying a premium is similar to making a month-to-month auto settlement.

Thomas Insurance Advisors - Questions

When you have a deductible, you are in charge of paying a details amount for coverage solutions before your health insurance plan offers coverage. Life insurance policy can be separated right into two main types: term and also long-term. Term life insurance policy offers insurance coverage for a specific duration, commonly 10 to three decades, and is a lot more affordable.This material is for educational purposes only and also might not be appropriate to all scenarios. Coverage subject to terms, problems, and accessibility. Plan issuance is subject to credentials. Allstate Insurance Business, Allstate Indemnity Business, Allstate Fire and also Casualty Insurance Provider, Allstate Residential Or Commercial Property as well as Casualty Insurer, Allstate North American Insurer, Northbrook, IL.

Excitement About Thomas Insurance Advisors

According to information from 2019, an auto accident can cost you more than $12,000, also without any injuries; it can set you back even more than $1. These expenses come from clinical expenditures, car damage, wage and also productivity losses, as well as more.These insurance coverages spend for clinical costs connected to the event for you as well as your passengers, despite who is at mistake. This also assists cover hit-and-run crashes and accidents with drivers that do not have insurance. If you're buying an auto with a financing, you may likewise require to include extensive as well as crash coverage to your plan to spend for damages to your vehicle because of cars and truck accidents, theft, vandalism, as well as various other hazards. https://www.giantbomb.com/profile/jstinsurance1/.

If you have a home loan, your lending institution possibly visit here needs a policy, however if you don't acquire your own, your lender can acquire it for you as well as send you the bill.

Thomas Insurance Advisors for Beginners

Residence insurance policy is a good suggestion, even if you've repaid your mortgage, due to the fact that it shields you against expenditures for property damage. It additionally secures you against obligation for injuries as well as residential property damage to guests triggered by you, your family members, or your pet dogs. It can also cover you if your residence is unliveable after a covered case, and it can pay to repair or reconstruct removed frameworks, like your fence or shed, harmed by a protected claim.Report this wiki page